E-GOVERNANCE

CYBER SECURITY TOOLS

Cybersecurity tools are essential for defending against digital threats. They include antivirus software, firewalls, intrusion detection systems (IDS), and virtual private networks (VPN). These tools protect against malware, unauthorized access, and data breaches. Antivirus programs detect and remove malicious software; firewalls control incoming and outgoing network traffic; IDS monitor for suspicious activities; and VPNs encrypt internet connections. Together, they form a multi-layered defense, safeguarding information and systems in an increasingly connected world

Antivirus software is the first line of defense in cybersecurity. It scans computers and networks for malicious code and activity, identifying and removing viruses, worms, and trojans.

Firewalls act as a barrier between trusted and untrusted networks, monitoring and controlling incoming and outgoing network traffic based on predetermined security rules.

IDPS tools are critical for identifying potential threats and responding to them in real-time. They analyze network traffic to detect patterns indicative of cyber attacks, such as unusual data transfers or protocol activities

VPNs create a secure, encrypted connection over a less secure network, like the internet. They ensure that sensitive data transmitted between remote users and the company network remains confidential and protected from eavesdropping.

CENTRAILSED E-CARD SYSTEM

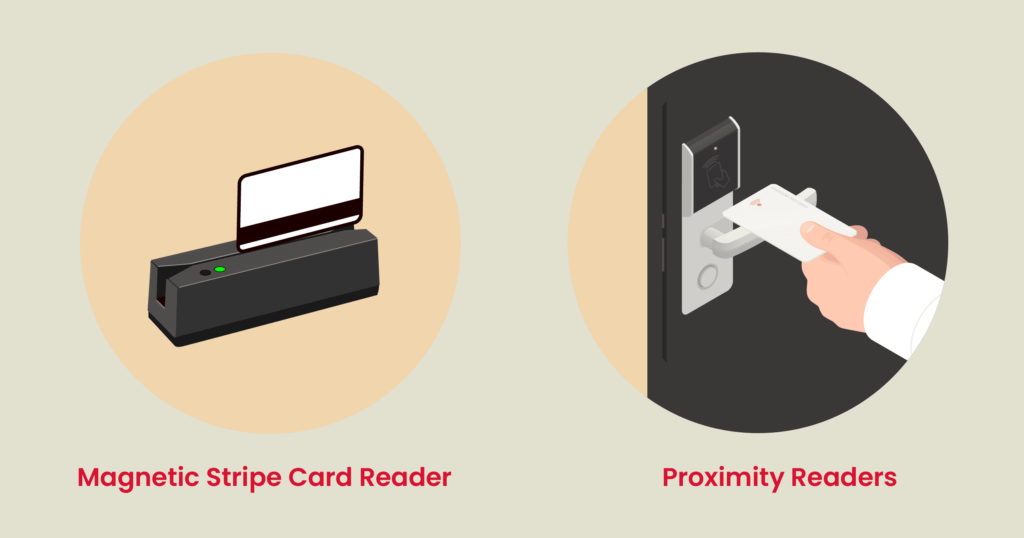

A centralized e-card system integrates various card-based services into a unified digital platform. It simplifies the management and use of e-cards for transactions, identification, and access across multiple sectors. This system enhances security, reduces administrative costs, and provides user convenience. It’s particularly useful in banking, corporate access, and public services, enabling efficient and secure electronic interactions. Centralized e-card systems ensure consistent standards.

Centralized e-card systems offer robust security features, safeguarding personal and financial data against unauthorized access and fraud.

By streamlining card management processes, centralized e-card systems significantly improve operational efficiency.

Centralized e-card systems provide unparalleled convenience by allowing users to access multiple services with a single card.

These systems collect vast amounts of data, which can be analyzed to gain insights into consumer behavior, spending patterns, and service usage.

ACCOUNTS & FUND MANAGEMENT SYSTEM

An Accounts & Fund Management System streamlines financial operations by automating accounting processes and managing funds efficiently. It integrates various financial activities such as bookkeeping, budgeting, expense tracking, and financial reporting into a single platform. This system ensures accurate, real-time financial data and compliance with regulatory standards. It facilitates fund allocation, monitors cash flow, and tracks investments, enabling better financial planning and decision-making.

The system streamlines various accounting tasks such as bookkeeping, budgeting, and expense tracking by automating these routine processes. This reduces manual errors and saves time.

By integrating all financial activities into a single platform, the system ensures that financial data is always up-to-date and accurate. This real-time data accessibility enhances compliance with regulatory.

The system facilitates efficient fund allocation, monitors cash flow, and tracks investments. This comprehensive oversight enables better financial planning.

With robust analytics and customizable reporting features, the system provides in-depth insights into financial performance.